Navigating the intricate realms of venture finance can often seem a daunting task, but not when you have a stellar educational powerhouse like the University of Oxford leading the way.

The Oxford Entrepreneurship Venture Finance Programme from Saïd Business School offers a comprehensive dive into the venture finance landscape, presenting both the investor and entrepreneur perspectives.

Let’s have a look at the specifics in this Oxford Entrepreneurship Venture Finance Programme review and see if the course is the right fit for you.

What is the Oxford Entrepreneurship Venture Finance Programme?

The Oxford Venture Finance Course is a meticulously designed, 8-week online program tailor-made for the ambitious, the visionary, and the relentless.

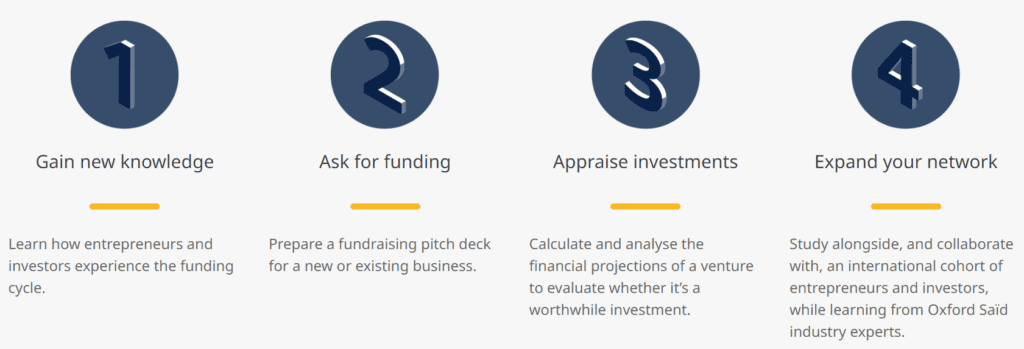

It’s structured to provide participants with a deep understanding of venture finance’s nuances from both the investor and entrepreneur viewpoints.

Starting from the initial fundraising phase, it walks you through the journey right until the final exit, ensuring you’re equipped with both theoretical knowledge and practical tools.

While it introduces you to various investors and investment avenues, it doesn’t stop there. The course offers an engaging learning experience by combining lecture notes, videos, exercises, and class discussions, drawing insights from professionals within the venture capital industry.

This is more than just an academic course; it’s a bridge to a global network and a step into the world of venture finance.

Oxford Entrepreneurship Venture Finance Programme – At a Glance

| Attribute | Details |

|---|---|

| Institution | Oxford University |

| Course Focus | Venture Financing and Entrepreneurship |

| Duration | 8 weeks |

| Format | Online with a mix of live sessions and self-paced modules |

| Pricing | £2,200 GBP |

| Faculty | Oxford faculty spearheaded by Dr. Thomas Hellmann, alongside a cadre of industry stalwarts |

| Major Modules | Venture Finance Foundations, Stakeholder Perspectives, Investment Landscape, Start-up Valuation Techniques, Investment Negotiation, Governance and Control |

| Unique Selling Points | Pedigree of Oxford, Contemporary Venture Finance Strategies, Industry Expert Insights, Collaborative Learning Environment |

| Target Audience | Venture Capitalists, Budding Entrepreneurs, Financial Analysts, Corporate Strategists, Investment Bankers |

Key Features & Highlights

- Global Recognition: Affiliated with Saïd Business School at the University of Oxford, one of the world’s leading institutions.

- Comprehensive Curriculum: Covering every facet of venture finance, from initial fundraising to the final exit.

- Practical Learning: Emphasis on real-world applications through exercises, case studies, and class discussions.

- Networking Opportunities: Connect with classmates from across the globe and engage with professionals in the venture capital sector.

- Dynamic Collaboration: Partnership with digital education provider GetSmarter, a 2U, Inc. brand.

- Alumni Network: Access to the Oxford Executive Education Alumni Group on LinkedIn upon successful completion.

Oxford Entrepreneurship Venture Finance Programme Pricing

A premium educational experience often comes with a price tag to match.

The Oxford Entrepreneurship Venture Finance Programme is priced at £2,200 GBP.

While the upfront cost might seem steep, one needs to factor in the reputation of the University of Oxford, the comprehensiveness of the curriculum, and the vast networking opportunities that come bundled with it.

Curriculum and Modules

The Oxford Venture Finance Course’s curriculum is meticulously crafted, encompassing every intricate detail of venture finance.

The modules are bucketed into the following primary areas:

- Venture Finance Foundations: Dive deep into the essence of venture finance, exploring its economic importance, key definitions, and foundational concepts.

- Investor Landscape: Navigate the various identities and perspectives of early-stage investors. Understand the merits and drawbacks of different funding avenues, from family and friends to professional late-stage investors.

- Fundraising and Financial Mastery: Grasp the essentials of fundraising, constructing financial statements, determining ‘financial ask’, and creating compelling investor pitch decks.

- Valuation and Investment: Decipher the art of valuation, interpret various methods, and analyze key drivers in practice. Additionally, discover the world of venture capitalists and the intricacies of venture capital funding.

- Negotiation and Deal Sealing: Learn to strike a balance in negotiations, explore stock options, the convertible note, and the facets of a term sheet.

- Growth and Financial Strategy: Understand the nuances of scaling ventures, dealing with financial difficulties, and the role of debt in a project venture.

- The Grand Exit: Examine the ‘exit’ process from both the entrepreneur and investor standpoints. This covers the initial public offering process, acquisitions, and buyouts.

In addition to the core modules, there are interactive case studies, quizzes, and ongoing project submissions ensuring a comprehensive grasp of venture finance.

Faculty & Teachers

Under the renowned canopy of Saïd Business School, University of Oxford, the Oxford Entrepreneurship Venture Finance Programme boasts stellar guidance from academic and industry leaders.

At the helm is Dr. Thomas Hellmann, the DP World Professor of Entrepreneurship and Innovation. A cornerstone in entrepreneurial finance, he engages deeply across Saïd, enriching various programs from MBA to executive courses.

Alongside him, the course features a mosaic of guest experts—ranging from CEOs like Agne Milukaite of Cycle.land to investment gurus like Irina Haivas of Atomico—ensuring participants receive a nuanced and holistic grasp of venture finance.

Pros

Let’s look at some of the positives of the Oxford Entrepreneurship Venture Finance Programme:

- World-Class Curriculum: Designed by the University of Oxford, it offers a comprehensive and contemporary view on venture finance.

- Renowned Faculty: Benefit from insights of leading global scholars and industry professionals.

- Prestigious Certification: From one of the world’s top institutions, adding significant weight to your professional profile.

- Global Networking: Connect with an international cohort of professionals and enter the Oxford Executive Education Alumni Group.

- Flexible Learning: With an 8-week online format, it caters to working professionals across time zones.

Cons

We’ve listed some of the improvements the Oxford Entrepreneurship Venture Finance Programme could make:

- Cost Prohibitive for Some: With a price tag of £2,200 GBP, it may be steep for individuals. However, the Oxford brand and networking opportunities can offer a significant return on investment.

- Intensive Curriculum: The extensive curriculum might be demanding for those with tight schedules. Yet, its rigorousness ensures a thorough understanding of the subject.

- Lack of Physical Networking: Unlike in-person courses, online formats might limit direct personal interactions. Still, the course’s design includes interactive sessions, enabling participants to engage and network digitally.

What I Like About the Oxford Entrepreneurship Venture Finance Programme

From an outsider’s perspective, the depth and breadth of the curriculum stand out, ensuring a holistic grasp of venture finance.

The affiliation with Saïd Business School and the University of Oxford is undoubtedly a mark of prestige.

What truly catches the eye, however, is the emphasis on real-world applicability.

The integration of case studies, discussions, and exercises demonstrates a commitment not just to theoretical knowledge, but to the practical tools one would require in the venture finance realm.

A Deep Dive into the Oxford Venture Series

The Oxford Entrepreneurship Venture Finance Programme is more than just an isolated course; it’s an integral part of a broader entrepreneurial voyage curated by Oxford University.

Nested within the prestigious Oxford Venture Series, this programme is seamlessly flanked by two additional, meticulously designed courses that provide a comprehensive view of the entrepreneurial landscape.

The Entrepreneurship: Venture Creation Programme offers participants a framework for birthing and nurturing robust business ideas, ensuring they are market-ready and primed for success.

Meanwhile, the Digital Marketing: Disruptive Strategy Programme equips professionals with the arsenal needed to navigate the digital world, zeroing in on customer-driven transformation strategies that set businesses apart in an increasingly digital marketplace.

Opting for the full suite? There’s more good news. Dive into all three courses and you’re in for a consolidated 15% markdown on the aggregate cost.

What Sets This Course Apart?

In an age where numerous courses are available at the click of a button, the Oxford Entrepreneurship Venture Finance Programme distinguishes itself with its impeccable academic pedigree.

Few courses offer such a blend of rigorous academic content with tangible industry insights.

The added privilege to engage with a diverse, global cohort and the potential to connect with Oxford’s vast alumni network offers an unmatched experience.

Who Should Take This Course?

If you’re an aspiring entrepreneur seeking to understand the labyrinth of venture finance or an investor keen to refine your strategies and insights, this program is tailor-made for you.

Finance professionals, consultants, and those looking to switch to the venture capital sector will find immense value in the program’s content and networking opportunities.

Bottom Line

The Oxford Entrepreneurship Venture Finance Programme is more than just a course; it’s an experience, a journey into the heart of venture finance.

With the backing of one of the world’s most prestigious institutions, an engaging curriculum, and opportunities to network with global professionals, this is an investment in your future that promises a significant return.

Don’t forget to have a look at our list of best CTO programs!

Frequently Asked Questions

What is the main objective of the Oxford Entrepreneurship: Venture Finance Programme?

The programme aims to offer a thorough understanding of venture finance from both the entrepreneur and investor perspectives. Participants will explore the entire funding process, from initial fundraising to the final exit, and will acquire practical tools and theoretical knowledge to effectively navigate this journey.

Who is the ideal candidate for this programme?

This programme is designed for individuals planning to start a new startup or those currently involved in one, and who wish to deeply understand the venture finance landscape. Both investors looking to analyze different funding opportunities and entrepreneurs wanting to prepare their business for fundraising will benefit. A basic understanding of finance or business is recommended.

How is this course different from other venture finance courses?

The programme is unique in its ‘two-hats’ approach to venture finance, providing insights from both the founder and investor viewpoints. It’s a collaboration between Saïd Business School, University of Oxford, and GetSmarter, combining academic rigor with technology to offer an immersive, collaborative learning experience tailored for busy professionals.

What will I receive upon successful completion of the programme?

Answer: Participants who successfully complete the programme will be awarded a certificate of attendance from Oxford Saïd, serving as a testament to their venture finance knowledge. The assessment is continuous and based on various practical assignments completed online.

Who is the Programme Director and what expertise do they bring?

Dr. Thomas Hellmann, the DP World Professor of Entrepreneurship and Innovation at Saïd Business School, University of Oxford, is the Programme Director. He has a rich background in entrepreneurial finance, innovation, and public policy. Dr. Hellmann has published in leading journals and has advised entities like the World Economic Forum and the Government of British Columbia.

Can I network with alumni after completing the programme?

Answer: Yes, upon successful completion and passing of the programme, participants gain access to the official Saïd Business School, University of Oxford Executive Education Alumni Group on LinkedIn. This platform allows you to network with past participants of other Oxford Saïd programmes and offers first access to School news.

Ben is a full-time data leadership professional and a part-time blogger.

When he’s not writing articles for Data Driven Daily, Ben is a Head of Data Strategy at a large financial institution.

He has over 14 years’ experience in Banking and Financial Services, during which he has led large data engineering and business intelligence teams, managed cloud migration programs, and spearheaded regulatory change initiatives.